How Much Bank Balance is Required for Canada Student Visa? As of 2023, for a Canada student visa, you must prove you have enough money to cover your first year’s tuition plus CAD 10,000 for living expenses. International students planning to study in Canada must demonstrate financial stability to cover tuition costs and living expenses during their academic stay.

Securing a Canadian student visa requires proving financial capability, an essential criterion that reassures the Canadian government of your ability to support yourself. The Canadian immigration authorities have set explicit guidelines to ensure that international students can afford their education and living without undue hardship.

This financial prerequisite safeguards the interests of both the student and the educational institutions. It also ensures that students can fully focus on their studies without excessive financial stress. Preparing adequate proof of funds is a critical step in the application process, and it aligns with Canada’s goal to foster a supportive educational environment for students from around the globe.

Table of Contents

Eligibility Criteria For A Canada Student Visa

Planning to study in Canada? Understanding the eligibility criteria for a Canada Student Visa is crucial. This includes meeting several requirements. The most important are academic eligibility and financial preparedness. Let’s dive into the essentials.

Basic Requirements For Applicants

- Valid passport – Your passport must be valid for the duration of your study.

- Acceptance by a Designated Learning Institution – You need a letter of acceptance.

- Proof of no criminal record – A police certificate might be necessary.

- Medical exam – You must be in good health and may need a medical certificate.

- Intent to leave after studies – Show you will exit Canada upon education completion.

Financial Evidence Necessary

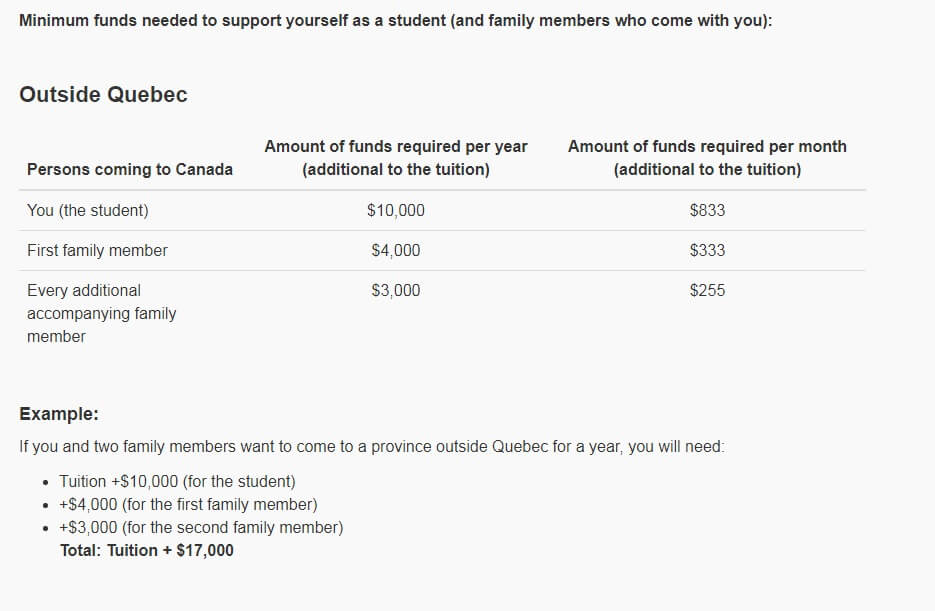

Financial stability is key to obtaining your student visa. The Canadian government requires proof that you can support yourself during your studies.

| Expenses | Estimated cost (CAD) |

|---|---|

| Tuition fees | Varies by program |

| Living costs | $10,000 for 12 months outside Quebec |

| Additional family members | $4,000 for first family member, $3,000 for each additional |

You must show you can cover these costs. This can be through:

- Bank statements – Latest statements showing sufficient balance.

- Scholarship or funding proofs – If applicable to your situation.

- Educational loan documents – From a bank indicating the loan amount.

- GIC (Guaranteed Investment Certificate) – If opted for this route.

Remember, showing a healthy bank balance reassures the officials of your financial capacity. This is essential for your Canada Student Visa application success.

Calculating The Required Bank Balance

Getting ready to study in Canada can be thrilling. A key step is showing you have enough money. Let’s figure out what ‘enough’ means when applying for your Canada student visa.

Tuition Fees And Tuition Deposits

Tuition costs vary by program and school. First, find your program’s fees on the school’s website. Now, take note:

- Undergraduate programs often cost between CAD 15,000 and CAD 30,000 per year.

- Graduate programs may range from CAD 15,000 to CAD 50,000 per year.

- Some schools ask for a tuition deposit before you arrive.

Sum these numbers to get your total tuition cost for visa purposes.

Living Expenses And Financial Buffer

To live in Canada, you need more than just tuition money. Food, housing, transport, and more must be in your budget. Remember the financial buffer.

| Expense Category | Estimated Cost |

|---|---|

| Housing | CAD 8,000 – CAD 14,000/year |

| Food and Groceries | CAD 3,000 – CAD 5,000/year |

| Transportation | CAD 800 – CAD 1,200/year |

| Miscellaneous (Books, clothing, etc.) | CAD 2,000 – CAD 3,000/year |

The Government of Canada suggests proof of CAD 10,000 for living costs. Add this amount to the tuition total. For provinces like Quebec, the amount varies.

Don’t forget an extra 10-15% buffer for unexpected expenses. It’s smart to have a cushion.

Providing Proof Of Sufficient Funds

As you prepare for your journey as an international student in Canada, providing proof of sufficient funds is a critical step. This proof showcases your ability to support yourself during your studies. Understanding what documents you need and avoiding common mistakes ensures a smoother visa application process.

Acceptable Financial Documents

For your Canadian student visa, present these documents to prove your financial readiness:

- Bank statements – Recent records showing ongoing balance and account history.

- Guaranteed Investment Certificate (GIC) – From a Canadian bank.

- Education loan confirmation – From a financial institution.

- Tuition payment receipt – If you’ve prepaid your program fees.

- Scholarship or funding letters – Issued by your institution or sponsor.

Common Mistakes To Avoid

When providing your financial documentation, avoid these pitfalls to improve your visa application’s chances of success:

- Submissions with insufficient history detail.

- Providing documents that are not updated or recent.

- Lack of minimum balance maintenance evidence.

- Using non-verified or unrecognized financial documents.

- Mismatch of sponsor names across different forms and documents.

Credit: www.linkedin.com

Impact Of Scholarships And Financial Aid

Understanding the financial requirements for a Canada Student Visa is crucial. Scholarships and financial aid can significantly impact the amount of money you need to show. These funds can reduce your required bank balance. Sponsored funds also need clear documentation.

Reduction In Required Bank Balance

When you receive a scholarship or financial aid, the total cost of your study in Canada decreases. Consequently, the bank balance you need to demonstrate to the immigration authorities reduces too. For example, if your tuition and living expenses amount to $20,000 and you receive a $5,000 scholarship, your bank statement needs to reflect adequate funds for just $15,000.

- Scholarships can cover partial or full tuition fees.

- Financial aid may include grants, bursaries, and waivers.

It is essential to include these details in your Student Visa application. They prove that you have the necessary funds to cover your expenses in Canada.

Documenting Sponsored Funds

If your studies are funded by a sponsor, this must be clearly documented. Sponsors can be parents, relatives, or organizations. The Canadian authorities require official letters or documents that confirm this sponsorship agreement. These documents should include:

| Document | Content |

|---|---|

| Sponsorship Letter | Name, relationship to student, commitment amount. |

| Bank Statements | Enough funds to support the student. |

| Financial Records | Records showing sponsor’s ability to support. |

Always ensure these documents are current and official. They must be issued by the bank or financial institution where the funds are being held.

Remember, each case is unique.

Proper documentation of scholarships and sponsored funds is key for a successful Student Visa application.

Maintaining Financial Health During Your Studies

So, you’re ready to hit the books in Canada, but what about your wallet? Studying abroad is exciting, but it’s vital not to overlook your financial health. Let’s chat about pocket-friendly living and finding work as an international student.

Managing Expenses In Canada

Life in Canada doesn’t have to break the bank. With smart budgeting, you can enjoy your studies without money woes. Here are some tips to keep your expenses in check:

- Create a budget to track everything you spend.

- Choose affordable housing, sharing a flat can save a lot.

- Cook at home more often than eating out.

- Use student discounts to save on travel and entertainment.

- Buy textbooks secondhand or opt for digital versions.

Paying attention to your spending helps prevent surprises. This way, you balance studies and finances smoothly.

Opportunities For Part-time Work

Need extra cash? Part-time jobs are a lifesaver for students. Not only do they help with living costs, but they also serve as real-world experience. Check out these job opportunities:

| Type of Job | Location | Average Pay |

|---|---|---|

| On-campus jobs | University | $15/hr |

| Retail positions | Malls | $14/hr |

| Food service roles | Cafes | $13/hr + tips |

| Tutoring jobs | Private | $20/hr |

Remember, your study permit outlines how many hours you can work. Stick to these limits to balance work and course demands.

Credit: www.canadavisa.com

Navigating The Visa Application Process

Applying for a Canadian student visa requires meticulous planning and smart preparation. Knowing the bank balance needed is crucial. It assures the Canadian government that students can fund their stay. This section helps students glide through the visa application process with ease.

Visitor visa How to apply Official Website Read More

Step-by-step Application Guide

Here is a simple guide to follow for your Canadian student visa application:

- Check the requirements.

- Gather all necessary documents. This includes proof of acceptance, identity documents, and financial evidence.

- Complete the visa application form.

- Pay the visa application fee.

- Submit the application. Do this online or at a Visa Application Centre.

- Wait for processing and respond to any additional requests.

- Prepare for arrival in Canada upon visa approval.

Expert Tips For A Successful Visa Interview

Here are some pro tips to nail the visa interview:

- Practice commonly asked questions.

- Be concise and honest in your answers.

- Show ties to your home country.

- Present a clear study plan.

- Provide proof of funds. Show you have the necessary bank balance.

Remember, a well-prepared candidate is often a successful one!

How to Submit Canada Visa Application Form Online? Read More

Credit: www.greentreeimmigration.com

Frequently Asked Questions Of How Much Bank Balance Is Required For Canada Student Visa?

What Is The Minimum Bank Balance For A Canada Student Visa?

The minimum bank balance required for a Canada student visa is typically equivalent to the cost of living plus tuition fees for one year. As a guideline, students should demonstrate they have between CAD 10,000 to CAD 11,000 for each year of study, excluding tuition.

How Does One Prove Financial Capacity For Studying In Canada?

To prove financial capacity for a Canadian student visa, applicants must submit bank statements showing adequate funds. Other acceptable documents may include a Canadian bank account in the applicant’s name if money has been transferred, a Guaranteed Investment Certificate (GIC), or proof of a student or education loan.

Are There Financial Requirements For Canadian Student Visa Renewals?

Yes, for renewing a Canadian student visa, applicants must continue to show they have adequate funds to cover tuition and living expenses. The financial requirements remain similar to the initial visa application process, emphasizing the student’s ability to support themselves financially.

Can A Bank Loan Be Used As Proof Of Funds For Canada’s Study Permit?

Yes, a bank loan can be used as proof of funds for a Canada study permit. Students must provide an official letter from the bank confirming the loan specifically granted for their education expenses. The loan amount must cover tuition and living costs.

Conclusion

Securing your Canada student visa involves financial planning. Ensure your bank balance meets the requirements, proving you can support your studies. Start this exciting educational journey with confidence. Remember, proper funding is key to a stress-free experience abroad. Ready your finances and embark on your Canadian academic adventure!